This post is part of a series in which I’m discussing several parts of my AI_at_Rappi presentation. In the latest post, we discussed how to evaluate a churn marketing campaign using a financial evaluation measure. In this one, we’re going to deep down in a couple of important concepts needed to fully being able to implement the aforementioned methodology. I’ll have to say that this post is going to be a bit more technical that the previous ones.

Financial evaluation of a churn model

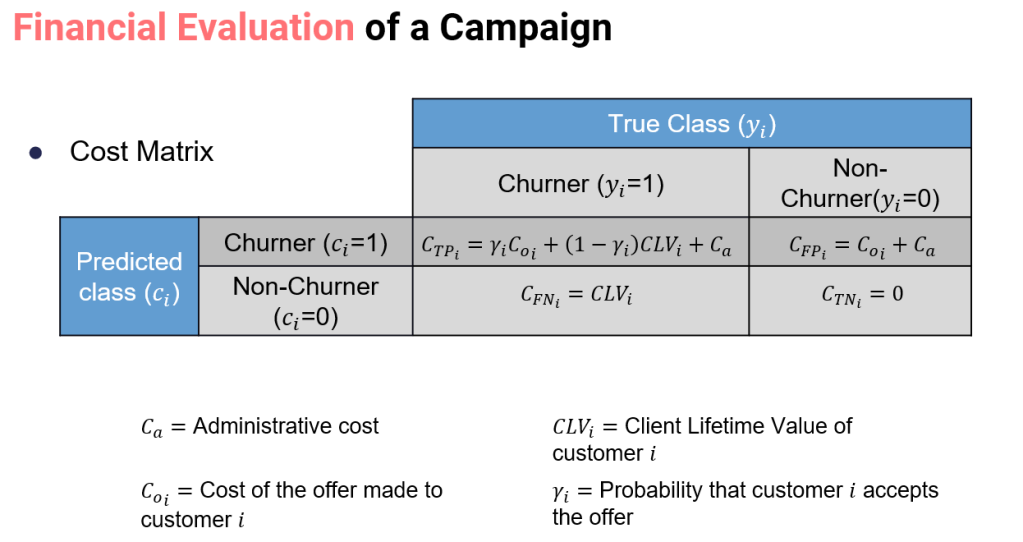

In summary, assuming that every churner or that every prediction error have the same financial impact is not realistic. We showed how to estimate the savings of a given churn model using this cost matrix:

There are a couple terms that we missed to explain in the previous post, in particular the Customer Lifetime Value (CLV), the gamma probability, and also which offer to give to each customer.

Let’s first understand how to estimate the CLV.

Customer Lifetime Value

One of the key values to calculate the cost matrix, is the customer lifetime value. Within marketing there exists a common misconception between customer profitability and customer lifetime value. The two terms are usually used in an interchangeable way, creating confusion of what the actual objective of a churn modeling campaign should be. Several studies have proposed models providing a unique definition of both terms (Milne and Boza 1999; Neslin et al. 2006; Pfeifer et al. 2004; van Raaij et al. 2003). Customer profitability indicates the difference between the income and the cost generated by a customer i during a financial period t. It is defined as:

where refers to the consumption of customer

during time period

, and

refers to the average marginal profit by unit product usage.

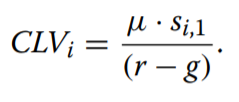

Moreover, we are interested to see what is the expected income that a particular customer will generate in the future, in other words, calculating the expected sum of discount future earnings (Neslin et al. 2006). Therefore, the is defined as:

where is the discount rate, and

the number of time period. Typically

should be considered large enough since without prior knowledge a customer is expected to keep being a customer for the foreseeable future. In practice

is set up to be

(Glady et al. 2009). Also, for simplicity it can be assumed that

, which means that there is a constant growth

in the customer consumption. Given that, the customer lifetime value can be re-written as

which in the case of , this is a geometric series meaning that it can be expressed as

Offer Analysis

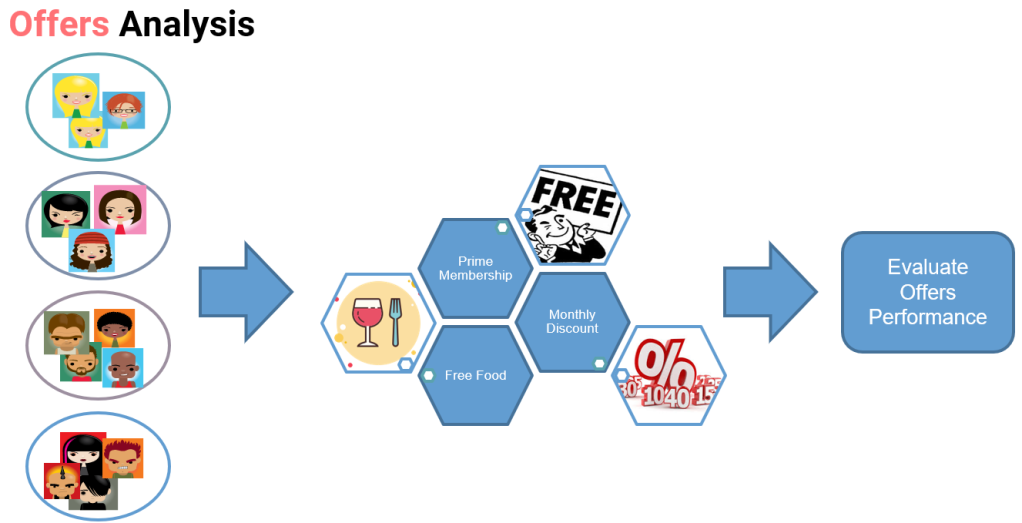

In practice companies have a set of offers to make to a customer as a part of the retention campaign, they vary from discounts, to upgrades among others. In the particular case of a marketplace such as Rappi, free deliveries, additional discounts, prime memberships and so on. Unsurprisingly, not all offers apply to all clients. For instance a customer that already has prime membership can not be offered that prime membership again. Moreover, an offer usually means an additional cost to the company and not all offers have not the same cost or the same impact in reducing churn.

Taking into account the cost and the implication of the offers, the problem can be resumed in making each customer the offer that will maximize the acceptance rate and more important reducing the overall cost.

In order to calculate the acceptance probability a champion-challenger process was made. First, the customers were grouped into clusters according to their behavioral and socio-economical characteristics. In particular the K-means algorithm was used (Marslan 2009). Then for a period of two months, randomly selected offers were made to the customers and their response was evaluated. Unfortunately, for confidentiality reasons we can not describe the different clusters, neither the actual offer made to each customer. Nevertheless, in the following figure, the average churn rate and acceptance rate

per cluster is shown. As expected, the higher the churn rate the lower the acceptance rate, as it is more difficult to make a good offer to a customer which is more likely to defect.

In this post we wanted to described with more details how to estimate the Customer Lifetime Value and also how it is possible to design experiments to estimate the probability of an offer acceptance gamma. Finally, in the next part of this cost-sensitive churn posts we’re planing to discuss how to include cost-sensitive machine learning algorithms into this analysis. Stay tuned.