This post is part of a series in which I'm discussing several parts of my AI_at_Rappi presentation. In the last two posts, we first discussed how to evaluate a churn marketing campaign using a financial evaluation measure and then how to estimate the customer lifetime value and also how it is possible to design experiments... Continue Reading →

Maximizing a churn campaign’s profitability with cost-sensitive Machine Learning, part 2

This post is part of a series in which I'm discussing several parts of my AI_at_Rappi presentation. In the latest post, we discussed how to evaluate a churn marketing campaign using a financial evaluation measure. In this one, we're going to deep down in a couple of important concepts needed to fully being able to... Continue Reading →

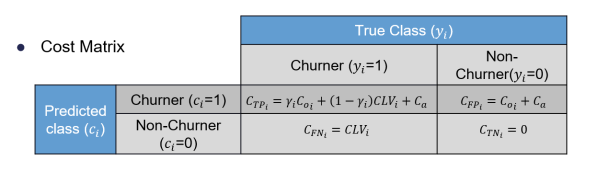

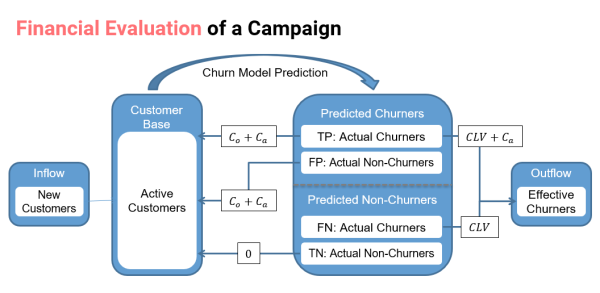

Maximizing a churn campaign’s profitability with cost-sensitive Machine Learning, part 1.

This post is part of a series in which I'm discussing several parts of my AI_at_Rappi presentation. In a previous post I discussed a particular algorithm for recommending restaurants called rest2vec. This time I wanted to talk about how to model customer churn using cost-sensitive machine learning. Churn modeling The two main objectives of subscription-based... Continue Reading →

Fraud Detection by Stacking Cost-Sensitive Decision Trees

Recently, we published a research paper showing how it is possible to detect fraudulent credit card transactions with a high level of accuracy and a low number of false positives. By using ensembles of cost-sensitive decision trees, we can save up to 73 percent of losses stemming from fraud. Here’s how. Classification, in the context... Continue Reading →

Fraud Detection That Accounts for Misclassification Using Cost-Sensitive Logistic Regression

Fraud detection is a cost-sensitive problem, in the sense that falsely flagging a transaction as fraudulent carriesa significantly different financial cost than missing an actual fraudulent transaction. In order to take these costs into account, companies should use a more business-oriented measure such as “Cost,” which allows companies to make decisions that are better aligned... Continue Reading →

Evaluating a Fraud Detection Using Cost-Sensitive Predictive Analytics

A credit card fraud detection algorithm consists in identifying those transactions with a high probability of being fraudulent based on historical fraud patterns. The use of predictive modeling/machine learning in fraud detection has been a topic of interest in recent years. Different detection systems based on machine learning techniques have been successfully used for this problem,... Continue Reading →